The Foreign Account Tax Compliance Act (FATCA) is a complex set of rules which aims to increase tax compliance by US citizens. It requires foreign financial institutions to determine their clients who are “US persons” and directly report to the US Internal Revenue Service (US IRS) information on their financial accounts. Failure to comply with the reporting rules and legislation will result in heavy penalties.

The Common Reporting Standard (CRS), which is similar to FATCA, also aims to prevent offshore tax evasion and protect the integrity of tax systems. It requires financial institutions in participating jurisdictions to identify the tax residencies of their clients and report financial accounts held by foreign tax residents to local tax authorities, which will in turn be exchanged with the tax authorities of the relevant jurisdictions.

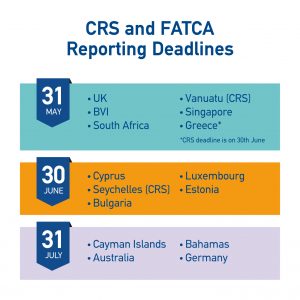

See below upcoming dates:

Challenges & Risks

Firms face a number of challenges and risks that need to be addressed in order to proceed with the pertinent submissions before the deadline.

Challenges

- Analysis & interpretation of the requirements, which consist of over 300 pages of guidelines to read

- More than 65 fields per record to complete

- Complicated multilevel XML files

- Different jurisdictions with each posing a different set of challenges

Risks

- Incorrect completion of CRS and FATCA reporting

- Failure to meet the reporting deadline and overall requirements

- Costly investment in resources to help you file the relevant submissions, which may place a burden on your budget

- Disruption of your daily operations

- Incorrect or false submissions that may result in a withholding penalty to specific payments

How can MAP FinTech assist you?

Given the complexity of the FATCA and CRS reporting, the challenges in keeping up with the regulatory updates and the penalties in case of non-compliance, it is reasonable to get ready early.

MAP FinTech can fully support your business’ regulatory reporting needs. We receive reportable information, construct the CRS and FATCA annual reports, and, for most countries, submit them to the relevant competent authority as prescribed by the relevant provisions of CRS and FATCA.

ΜΑΡ FinTech’s CRS and FATCA Reporting Services provide a user-friendly approach to receiving, validating, transforming and submitting the relevant information required under the CRS/FATCA reporting and due diligence rules.

These services are delivered via our powerful and award-winning Polaris platform, together with the rest of its reporting offerings and our team of experts’ impeccable support services.

ΜΑΡ FinTech’s CRS/FATCA – Key Features

- Cost-efficient integrated reporting solutions provided under a single platform.

- Highly automated and scalable solution that can report as many accounts as you have.

- Flexible in the way it receives data, either via standard templates or raw data.

- Multiple reporting health checks for both content and schema and automatic filtering of erroneous entries.

- Automatic conversion of data to XML and separation of files based on tax residency.

- Submissions to various tax authorities worldwide.

- On-going communication with regulators to ensure the system reports reflect regulatory updates and changes.