Partner up with MAP FinTech today to overcome this challenge.

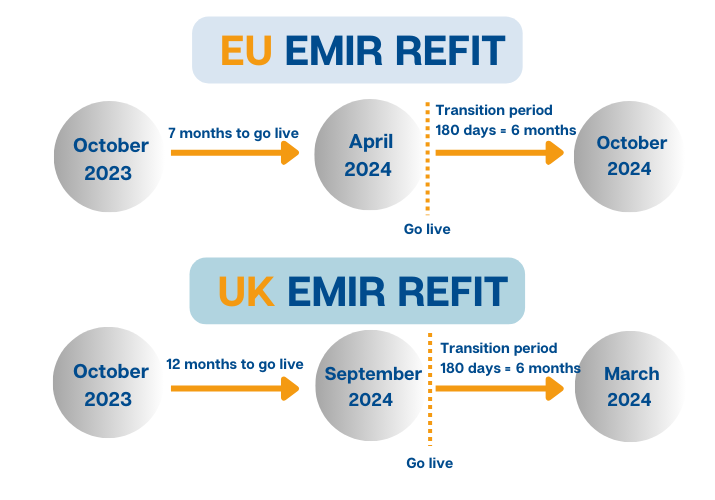

As the deadlines for implementing EMIR reporting changes approach in the EU (April 29, 2024) and the UK (September 30, 2024), it’s imperative to understand the intricacies of these new requirements.

From the reporting start date onwards, all reports submitted by the Reporting Counterparties and Entities Responsible for Reporting to the TRs will have to comply with the new regulatory requirements. This refers to derivatives that will be concluded after the reporting start date, as well as to any modifications or terminations reported after that date, irrespective of when the derivative was concluded, meaning that it could apply to an outstanding derivative (i.e. a derivative concluded and reported before the reporting start date).

Specifically, reporting entities will be provided with a transition period of 180 calendar days to update their outstanding derivatives to comply with the new regulatory requirements. In order to do this, they can use a special event type named ‘Update’ unless they have submitted a full message report with the action type ‘Modify’ or ‘Correct’ where they will need to include the full details of the derivative report in accordance with EMIR REFIT’s new Regulatory and Technical standards.

It is crucial to note that EU and UK EMIR REFIT introduce 87 and 88 new fields, respectively. Moreover, a significant number of fields have undergone modifications in terms of their name, description, acceptable values, or a combination of factors.

The above showcases the substantial preparatory work that Reporting Counterparties and Entities Responsible for Reporting will be required to perform, as they must update all affected fields for outstanding trades to meet the new standards. A noteworthy exception is that reporting entities should not create new Unique Trade Identifiers (UTIs) for outstanding derivatives, even if the UTI is not fully compliant with the new format requirements. However, any other fields affected by EMIR REFIT in the context of outstanding trades must adhere to the revised requirements when reporting.

It’s important to emphasise that the transition period does not impact the obligation to report relevant events by T+1. This means that any event occurring after the reporting start date must be reported by the end of the following working day (T+1). Undoubtedly, meeting this requirement poses a significant challenge for reporting entities.

Moreover, under the new reporting standards, certain reporting entities might be required to make adjustments to their reporting style or changes to the way they report collateral and valuations messages. Once more, this underscores that reporting entities must meticulously formulate their action plans and implement them all at once to ensure that their outstanding trades will promptly conform to the updated standards. Insufficient readiness in this regard could potentially render reporting entities vulnerable.

Furthermore, it is essential to note that reporting entities not utilizing delegated reporting and having counterparties bound by the same reporting obligation must initiate communication with these counterparties concerning the treatment of outstanding trades. This communication aims to coordinate the required adjustments around outstanding trades to ensure the alignment of both sides with EMIR REFIT regulations.

Lastly, a crucial point to grasp is that all the preparatory measures outlined above must be executed concurrently with the ongoing EMIR reporting procedures to ensure that the current EMIR reporting processes remain unaffected and operational until the final relevant date.

At MAP FinTech, we hold substantial expertise in effectively managing migration and transition phases, as well as addressing outstanding trades within these contexts. Our proven strategies have been successfully applied on numerous occasions in the past during previous regulatory updates like EMIR, as well as migrations of reporting entities from other Trade Repositories and service providers. Specifically, our comprehensive toolkit streamlines the process of automatically updating outstanding trades in one go, adhering to the new standards and minimizing the burden on the reporting entity’s end.

MAP FinTech can fully assist any firm under EMIR Reporting to seamlessly adapt to the evolving reporting requirements brought on by EMIR REFIT. Contact our team of experts and learn how you can benefit from our innovative and comprehensive regulatory reporting solutions.