In today’s dynamic global financial environment, regulatory compliance remains a critical focus for financial institutions. Frameworks like the Common Reporting Standard (CRS) and the Foreign Account Tax Compliance Act (FATCA) are pivotal in the fight against tax evasion, promoting greater transparency in cross-border financial transactions. Yet, for institutions operating across multiple jurisdictions, navigating these regulations can be a complex and resource-intensive challenge.

The Growing Complexity of Compliance

The landscape of CRS and FATCA compliance is continuously evolving, with regulations that differ by country and change frequently. Financial institutions must not only keep pace with these updates but also implement them accurately in their processes. Failing to do so can result in steep penalties, reputational harm, and potential legal consequences—making regulatory compliance a non-negotiable priority.

The Role of Technology in Compliance

Technology has become indispensable in meeting compliance obligations. Regulatory technology (RegTech) solutions provide the tools to streamline compliance processes, automating key tasks like data collection, validation, and reporting. This reduces the risk of errors and helps institutions maintain accuracy and efficiency while managing large volumes of data.

Why Choose MAP FinTech for CRS and FATCA Reporting?

At MAP FinTech, we specialise in providing cutting-edge RegTech solutions that simplify the complexities of CRS and FATCA reporting. Our tailored services are designed to support financial institutions by delivering a seamless compliance experience and allowing them to stay focused on their business priorities.

Here’s what sets MAP FinTech apart:

- Cost-Effective Solutions: An integrated platform that consolidates reporting processes, enhancing both efficiency and affordability.

- Automation and Scalability: Our solutions handle high-volume data effortlessly, making them suitable for institutions of any size.

- Flexible Data Management: We accommodate various input formats, whether standard templates or raw data, for greater adaptability.

- Rigorous Accuracy Checks: Our system includes built-in health checks to ensure both schema and content accuracy, eliminating erroneous entries.

- Advanced Data Processing: Automatic conversion of information to XML, with files segmented by tax residency for accurate submission.

- Global Coverage: Submissions are supported across multiple jurisdictions, ensuring compliance with international tax authorities.

- Up-to-Date Regulatory Alignment: We maintain continuous communication with regulators to stay ahead of updates and incorporate the latest requirements.

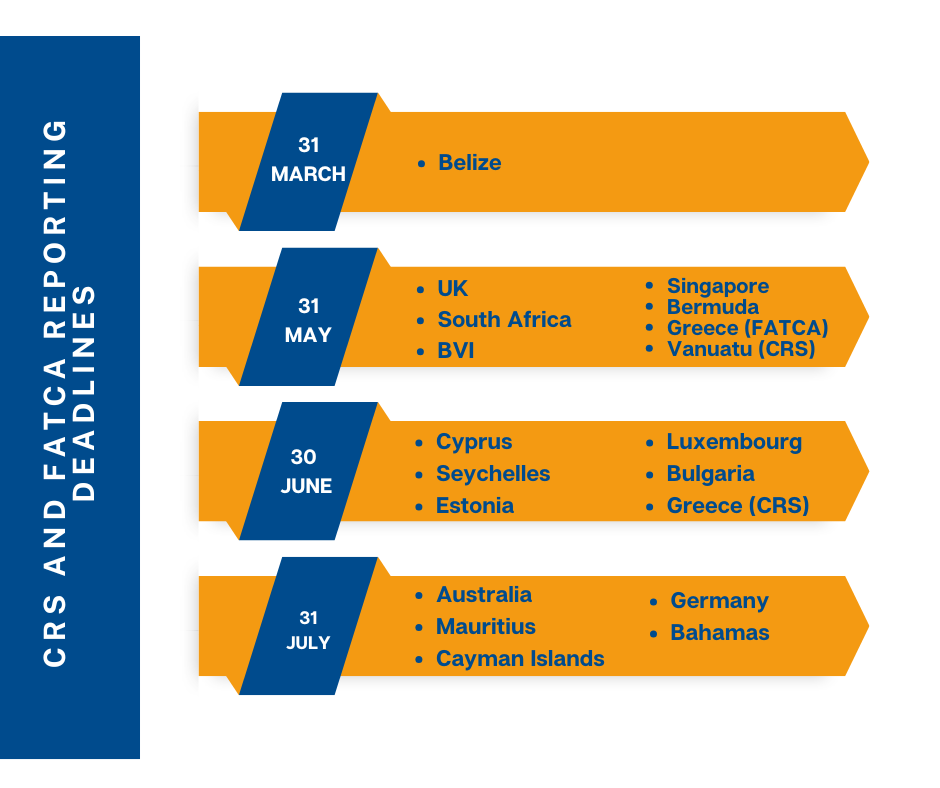

As shown in the image below, the reporting deadline to the relevant tax authorities in most participating jurisdictions is near. The importance of being prepared cannot be overstated. Institutions must act promptly to meet their obligations, avoid penalties, and ensure compliance.

Be Prepared with MAP FinTech

Non-compliance is costly, but staying ahead doesn’t have to be difficult. MAP FinTech’s automated and scalable RegTech solutions make CRS and FATCA reporting straightforward, reliable, and efficient.

Don’t wait until the deadline is upon you—contact our team today to learn more or schedule a consultation with one of our experts.