EMIR REFIT

What is EMIR REFIT:

The European Commission's regulatory fitness and performance program (REFIT) periodically reviews and enhances European legislations. In 2019, the EU's EMIR regime underwent this process, resulting in changes implemented in July of the same year.

In June 2022, the new Implementing and Regulatory Technical Standards (ITS and RTS respectively) pursuant to EMIR-REFIT were published in the Official Journal of the EU, while in the UK, the FCA published its policy statement PS23/2 in February 2023. The EU’s ITS and RTS, as well as the FCA’s Policy Statement, update the current reporting structures mandated under EU and UK EMIR to harmonise with CPMI-IOSCO Technical Guidance on the Harmonisation of critical OTC Derivatives Data Elements (other than UTI and UPI).

EMIR REFIT Primary objectives

- Minimise the regulatory burden on small and non-financial counterparties while retaining transparency in the market.

- Enhance the accuracy and quality of reported data to regulators by simplifying and harmonising requirements.

- Improve the efficiency and cost-effectiveness of clearing processes by streamlining procedures and reducing associated costs.

- Align with international standards and provide clearer rules and guidance.

- Assist regulators in monitoring and managing systemic risks in the market by strengthening their supervisory powers.

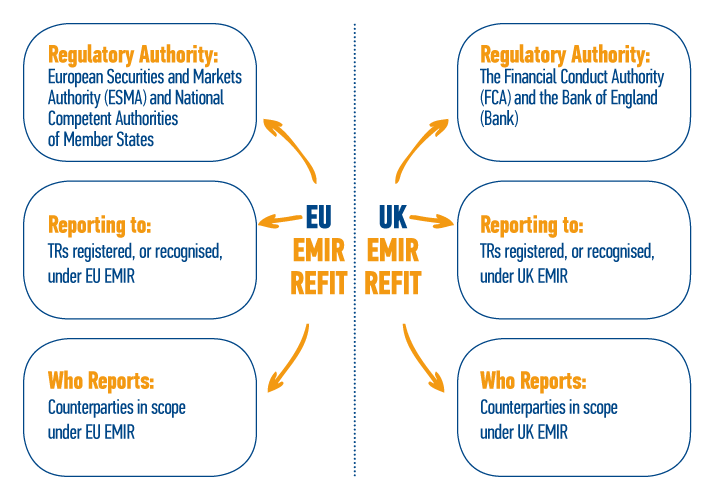

Who is impacted by the EMIR REFIT

- Financial counterparties regulated under MiFID II, such as Banks, Investment firms, Asset managers, Fund Managers, Insurance Firms, and Central Security Depositories

- Non-financial counterparties, such as corporates and non-financial institutions not regulated under MiFID II

- Central counterparties (CCPs)

- Trade repositories

- Regulators

Financial and non-financial counterparties and central counterparties (CCPs) are subject to report under EMIR REFIT, ensuring comprehensive reporting coverage in the derivatives market.

All counterparties and CCPs must report derivative contracts, modifications, and terminations to a trade repository.

- EU/EEA-based entities report to an EU trade repository.

- UK-based entities report to a UK trade repository.

- Requirements vary based on counterparty type.

EMIR REFIT Key changes

- Unique Product Identifier (UPI): At an international level, CPMI-IOSCO finalised its guidance on the UPI in 2017, and the relevant ISO standard was published in 2021 (ISO 4914:2021). The new ITS and RTS under EMIR-REFIT require reporting parties to report a UPI issued via centralised operator, the ANNA Derivatives Service Bureau.

- Reportable fields: Additional fields are included in the new reporting regime, such as identifiers for crypto-related assets and revised lifecycle event fields.

- Matching/Reconciliation: Under the EU’s updated rules, additional fields will be matched by the Trade Repositories (TRs) for the double-sided matching exercise, including but not limited to valuation-related fields. Some fields will be reconciled by the TRs immediately upon the start of the reporting obligation, but others will begin reconciling 2 years after the reporting start date.

- Position Level Reporting: EU’s EMIR REFIT introduces a set of conditions on when counterparties are allowed to implement position-level reporting. One of the conditions is that the reports relate to Exchange Traded Derivatives, or derivatives cleared by a CCP, or to Contracts for Difference that are fungible with each other and can be replaced by a position.

- ISO 20022 XML: following coordination at an international level, the use of the ISO20022 XML standard for all reports relating to EMIR is mandated.

- UTI Generation: Implementation of the ISO 23897:2020 on the structure and elements of the UTI. Moreover, the ITS assigns a clear determination path on which of the counterparties to a derivative trade should generate the UTI, as well as clear deadlines for the generating entity to communicate the UTI to the other party.

Standalone Tools for EMIR REFIT

MAP FinTech team has developed new tools to assist with the changes in reporting requirements, including the UPI Link search tool and XML Con.Vert tool.

- UPI Link Search Tool

This tool helps companies match their products’ attributes precisely to those already issued Unique Product Identifiers (UPIs) in ANNA-DSB database, ensuring that reporting companies use the correct UPI Code in their transaction reporting. - XMLCon.Vert tool

This tool leverages a diligently crafted template to seamlessly convert CSV data into the requisite XML format mandated by the chosen Trade Repository (TR) during your onboarding journey. Our methodical approach and the embedded validations ensure compliance with the utmost accuracy, sparing you the arduous burden of manual validation and conversion tasks. XMLCon.Vert tool can also be used extended with the UPI Link Search tool.

We are a leading award-winning global regulatory technology provider, highly regarded for our proprietary reporting technology and exceptional client-centric after-sales support. As one of the first providers in Europe to report under the European Market Infrastructure Regulation, with billions of transactions reported successfully so far, we have built a reputation for excellence, coupled with the necessary regulatory expertise and technological innovation to assist firms in navigating their respective regulatory obligations.

Contact our team of experts today and achieve a smooth transition to the changes in reporting requirements brought on by EMIR REFIT.