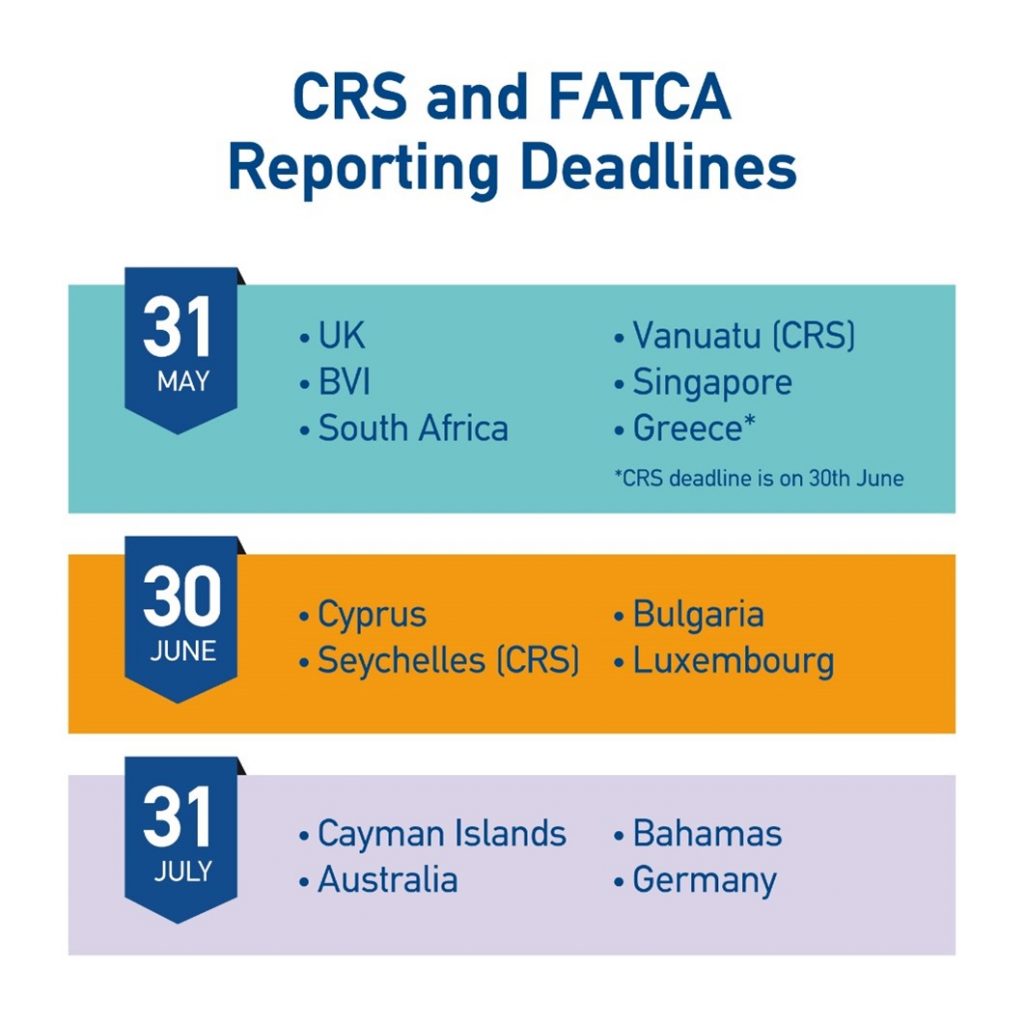

The clock is ticking for your annual FATCA and CRS submissions!

As shown below, the reporting deadline to the relevant tax authorities in most participating jurisdictions is set for between the end of May and July 2022.

What We Deliver

With this in mind, MAP FinTech can fully support your CRS and FATCA reporting needs.

ΜΑΡ FinTech’s CRS and FATCA Reporting Services provide a user-friendly approach to receiving, validating, transforming, and submitting the information required.

More specifically, our solutions receive the reportable information, construct the CRS and FATCA annual reports, and, for most countries, submit them to the relevant competent authority as prescribed by the relevant CRS and FATCA reporting and due diligence rules.

These services are delivered via our powerful, award-winning Polaris platform, including its many other reporting solutions and our team’s impeccable support services.

Key Features

- Cost-efficient, integrated reporting solutions provided under a single platform.

- Highly automated and scalable solution that can report on as many accounts as you have.

- Flexible in the way it receives data, either via standard templates or raw data.

- Multiple reporting health checks for both content and schema and the automatic filtering of erroneous entries.

- Automatic conversion of data to XML and separation of files based on tax residency.

- Submissions to various tax authorities worldwide.

- On-going communication with regulators to ensure the system reports reflect regulatory updates and changes.

What Sets Us Apart

- Award-winning RegTech provider with ample regulatory expertise

- One-stop compliance solutions

- Comprehensive support services